Maintaining tax revenues for Haredim in 2065 requires 16% increase

Governor of Bank of Israel: ultra-Orthodox Israelis must enter labor market

A speech given by the Governor of the Bank of Israel last month reminds us of the danger to the future of the State of Israel if we do not recognize and combat evil. He estimated that the ultra-Orthodox parties’ refusal to enable the full integration of ultra-Orthodox men into the job market and include core curricular studies in their school curricula, will require raising taxes on the rest of the public by about 16%!

05/01/2020 02:20

Tags: Bank of Israel · ultra-Orthodox · Haredim · economy

The Governor of the Bank of Israel's full speech can be found here. Selections from the speech may be found below:

Click for FULL size

"... Israeli society as a whole, and obviously the ultra-Orthodox community within it, must recognize the economic necessity of integrating the ultra-Orthodox community in the future labor market...

"GDP per capita in Israel remains lower than the OECD average. The ultra-Orthodox share of the population is constantly increasing, and is expected to reach one-third by 2065. Without fully integrating the ultra-Orthodox (and other population groups) in the future labor market, we will not be able to come close to the standard of living of the wealthy countries, and there is even a concern that we will decline in that ranking over the years, since the ultra-Orthodox community is becoming more and more significant in terms of its size. A simulation carried out at the Bank of Israel shows that integrating ultra-Orthodox men into the labor market and providing them with the appropriate education will significantly increase per capita GDP.

"While just 7 percent of households today are ultra-Orthodox, they constitute about 16 percent of poor households in Israel...

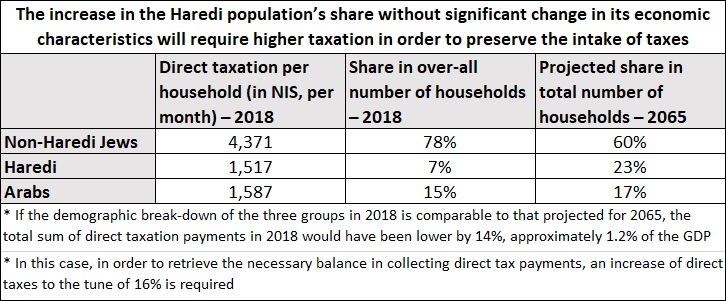

Direct tax payments by ultra-Orthodox households are about one-third those of other households. If the demographic trends are maintained and ultra-Orthodox participation in the labor market remains as it is today, maintaining tax revenues as a share of GDP will require a 16 percent increase in direct taxes in 2018 terms...

"Direct tax payments by ultra-Orthodox households are about one-third those of other households. If the demographic trends are maintained and ultra-Orthodox participation in the labor market remains as it is today, maintaining tax revenues as a share of GDP will require a 16 percent increase in direct taxes in 2018 terms...

"... the employment rate of ultra-Orthodox men is lower than the general rate for men, while the upward trend has been halted since 2015, and there even seems to be some downward trend. We can see that policy measures had an effect on the employment rate. Another example, the take-up rate of the earned income tax credit among the ultra-Orthodox is relatively high...

"The wage gaps among me are due to both the low number of work hours and to earning capacity—gaps that have widened over the years. The gap in earning capacity can be explained by the differences in various qualities of the employee: education, employment duration, and basic skills. These gaps begin with scholastic achievements, and are reflected in employee skills, particularly among younger employees. Later on, the gaps are reflected in low enrollment rates and very high drop-out rates in higher education. These are all reflected in low skills in the labor market, and in relatively low wages. among ultra-Orthodox workers...

"... The integration and advancement of the ultra-Orthodox community in the Israeli economy are very important to the continued growth and prosperity of the Israeli economy..."